It’s only the first week of February, but home buyers are already seeing fierce competition after a drop in interest rates, and inventory just is not quite keeping up yet. While we are seeing an increase in homes hitting the market compared to the previous few months, supply is not keeping up with demand. Speaking to fellow agents in our network, MANY properties are receiving multiple offers with many competing buyers on a single property. That means if you’re looking to buy, it’s important to be prepared and be ready to play hard ball when it comes to the right property.

We asked Tony Benallo, a 20 year mortgage industry veteran and President of Venture Financial Inc, about what you can do to be best prepared for the increased competition this spring: “In the ever-evolving landscape of real estate, navigating a market shift with lower interest rates and heightened competition demands both anticipation and preparedness. To thrive in this dynamic environment, borrowers should be prepared for a faster-paced process and rising home prices. Fortify your approach with a strong pre-approval, strategic negotiation skills, and a readiness to adapt your budget to changing market dynamics. In a market where decisive action is paramount, staying informed, working closely with your real estate agent, and having a responsive lender by your side will be key to securing the home of your dreams.”

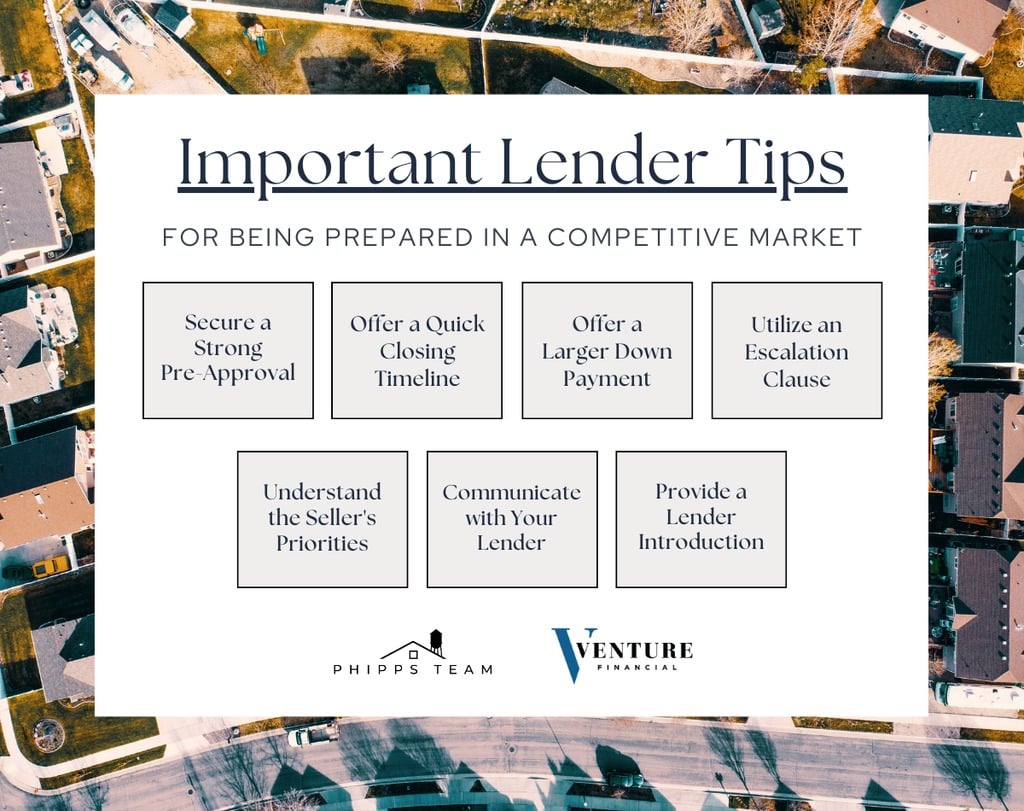

Tips from Tony and the Venture Financial team:

Secure a Strong Pre-Approval: Work closely with your lender to obtain a solid pre-approval. This not only demonstrates your financial readiness but also assures sellers that the financing process is likely to proceed smoothly.

Quick Closing Timeline: Coordinate with your lender to propose a realistic yet expedited closing timeline. Sellers often prefer a quick and efficient closing process, and this can make your offer more attractive.

Offer a Larger Down Payment: If financially feasible, consider increasing your down payment. A larger down payment can make your offer stand out and instill confidence in the seller regarding your commitment.

Escalation Clause with Financing Terms: If allowed in your area, consider including an escalation clause not just for the purchase price but also for financing terms. This demonstrates your willingness to adjust your offer to secure the deal.

Understand the Seller’s Priorities: Try to understand the seller’s priorities. Sometimes, it’s not just about the highest offer. Knowing what matters most to the seller can help you tailor your offer to their needs.

Open Communication: Maintain open and transparent communication with your lender. Keep them informed about your home search progress and any changes in your financial situation promptly.

Provide a Lender Introduction: When submitting your offer, consider including a brief introduction of your lender. This introduction can highlight the lender’s reputation, experience, and commitment to a smooth transaction.

It’s crucial to prepare to move quickly and be ready to write a competitive offer if you find “the one.” And with the increased competition, prices are once again rising. If your goal is to buy a home in 2024, the time is now, before we return to a market like from 2020-2022! Reach out to The Phipps Team today to talk about your home buying goals and how we can help you get into a new home this spring.